Out of 10 million private homes in Australia, more than 60% are currently mortgaged. But for a mortgage to be secured, certain thresholds need to be achieved. The most standard of which is a 20% deposit.

So what happens if you don’t have enough to meet the deposit?

That is when Lenders Mortgage Insurance (LMI) may come in handy. At Calibre, we have a team of experts on hand to help you with your buying queries.

Here we share more about LMI and how it could help you.

How Does Lenders Mortgage Insurance Work?

Lenders Mortgage Insurance is a type of insurance cover that protects the lender against a possible home loan default. It is paid for by the mortgage holder in either one of two events:

- When their deposit fails to meet the required 20% minimum

- When the bank is unable to determine the borrower’s ability to meet loan repayments

In assessing your deposit amount, the lender uses the loan-to-value ratio.

Loan = the sum you wish to get approved.

Value = your deposit amount.

The higher the ratio, the less likely you are to qualify for a given mortgage. And the more you’ll essentially have to pay in lenders mortgage insurance premiums.

Typically, the highest acceptable LVR for consideration by Australian banks is 95%. (A minimum of 5% deposit.)

With a lender’s mortgage insurance policy in place, the bank from whom you secure a loan may be able to claim reimbursement.

Example of LMI in Practice

In this example, the borrower has taken out a home loan amount of $800,000 but mid-way through their agreement, they are unable to keep paying the loan.

The bank repossessesthe property and puts it up on the market. They’re only able to sell it for 75 cents on the dollar of the loan amount (that’s $600,000).

This means the borrower is at a shortfallof $200,000. And this is the precise loan amount that the bank can claim from your insurance LMI provider.

The borrower is then responsible for reimbursing the insurancer the claimed amount.

Benefits of Lenders Mortgage Insurance

Though LMI is essentially in place to protect the lender, it offers prospective buyers better access to Australian credit facilities.

LMI enables borrowers to access home loans from lenders when they meet the lending requirements, but do not have the required deposit.

| IMPORTANT: Do not confuse Lenders Mortgage Insurance (LMI) with Mortgage Protection Insurance (MPI). Unlike LMI, Mortgage Protection Insurance is taken out by the borrower for their own sake — if they are unable to meet the financial obligation to the lender. |

How Much Does LMI Cost?

Australian insurers offer their Lenders Mortgage Insurance policies at different rates.

The precise cost of LMI will depend on several different factors.

Policies are calculated based on the following:

Your Accrued Savings

If you’re able to demonstrate a good amount of liquidity to the lender, you’d be in a strong position. Your savings will not only determine your LMI cost but also whether or not you even have to pay LMI.

The Purpose of Your Mortgage

The lender will need to know the function your home is meant to serve. This will help in assessing whether you qualify for financing.

Your home might be meant for any of these:

- A residential home — a residence where you intend to live

- Rental home — a property which you intend to lease out to tenants

- Storage premise — a silo, or a cargo hold for goods

- Commercial — a business office, either proprietary or rental

Your Employment Status

While assessing your loan request, your bank will require you to provide certain documents. This will be used to assess your ability to make home loan repayments throughout the required period. These might include payslips or a contract of employment.

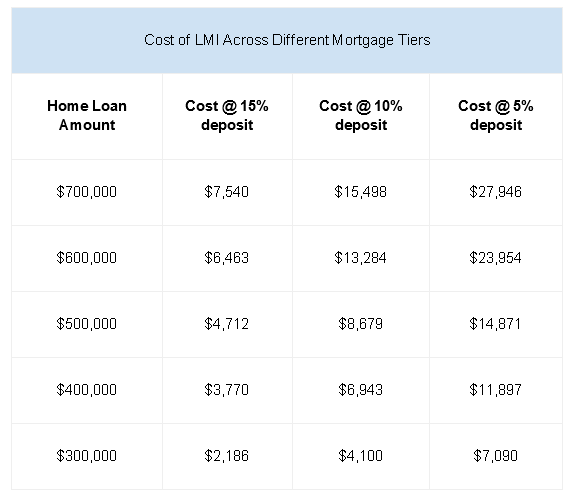

The Loan Principal Amount

Generally, the more you wish to borrow, the more liability you pose to the lender. And, the more you will have to pay in LMI premiums.

Genworth Financials provide this comparison of average LMI costs across different loan amounts:

How To Avoid or Reduce LMI Premiums

Get a Guarantor

If the borrower can get the backing of a creditworthy guarantor, the lender may forgo imposing an LMI policy.

A guarantor can be anyone — from a friend to a family member who is willing to accept responsibility if you are unable to meet the demands of your home loan.

Demonstrate Sufficient Liquidity

Australian lenders will often favour borrowers working in prestigious professions.

Borrowers working in specific fields will qualify with an LVR of 93% — oftentimes, this figure might get to 95%. These fields include:

- Legal practitioners (barristers, solicitors, magistrates, judges)

- Accounting professionals (auditing execs, CFOs, investment analysts)

- Medical practitioners (dentists, surgeons, cardiologists)

The onus is on the borrower to demonstrate how their work guarantees less financial risk to the lender. This won’t only reduce the loan insurance costs; it could do away with them entirely.

Apply for First Home Loans Deposit Scheme

The First Home Loans Deposit Scheme is an Australian government initiative. It targets aspiring homeowners looking to buy their first property.

It’s offered as a relief for those who don’t yet have enough savings to meet the deposit threshold, but who are nonetheless liquid and creditworthy enough to warrant little to no risk.

It is open to 10,000 applicants every year who meet certain eligibility requirements. With it, there are no LMI requirements imposed on your loan contract.

Ditch the Loan For Now and Grow Your Savings

If you’re not a fan of the thought of being responsible for your lender’s cover, then biding your time to build your savings might be the right option.

Consider pushing back the loan application for now — at least until such a time as when you have the entire 20% saved up.

We Are Real Estate Experts

Whether you’re a first-time buyer or a property investor, we have a dedicated team on hand who are ready to assist.

You can reach us on 07 3367 3411 or get social here: