There has been many questions from Brisbane Homeowners and Brisbane Property Investors regarding whether it is a good time to sell and whether COVID-19 has had an affect on the potential value of their home. According to Corelogic, housing values have generally been insulated by negative economic financial shocks but have been more reactive to credit tightening events. However there has been a significant decline in transactional volumes from these previous financial shocks such as Black Monday (Oct 87), Asian financial crisis (Dec 97), Tech wreck (Sep 11).

Corelogic reveals that Brisbane housing values were well into a growth phase prior to COVID-19. Brisbane has held up relatively well compared to Melbourne property market after COVID-19.

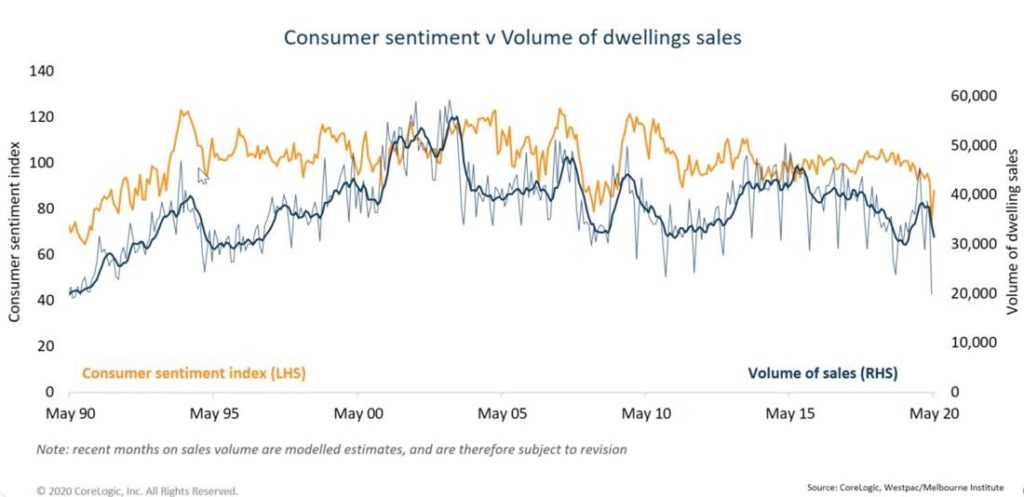

Corelogic reported that sales were 35% lower over the month of April. There is a strong relationship between property sales and consumer sentiment and with consumers less confident after COVID-19 was classified as a pandemic and with social distancing, households are less able to make high commitment decisions during this time. Source: Westpac/Melbourne Institute and Corelogic.

According to the RBA Governor, the record low cash rate level is expected to stay at this rate for a couple of years, and along with restrictions loosening up in Queensland and with Queensland really showing positive signs of keeping the virus contained, the Queensland market has seen that in May consumer sentiment rebounded by 80% from April’s sentiment. We should see a slight uplift in May and steadily trend up from here as long as we can keep the virus contained.

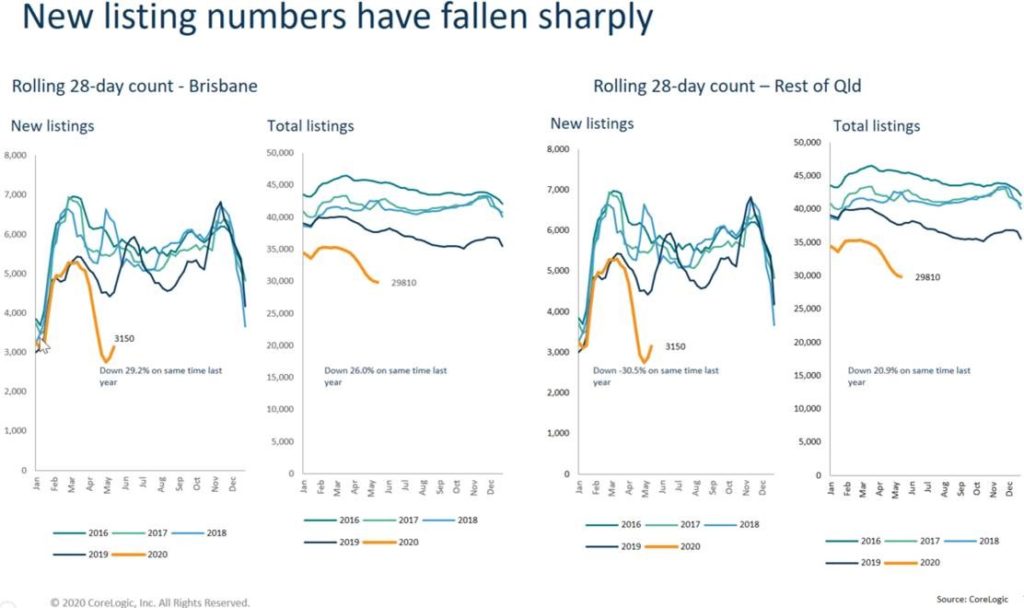

Corelogic has reported a reduced listings on the market in Brisbane, 30% below this time last year. The amount of properties on the market should be trending upwards but still around 30% less than listings last year, which signals that there isn’t an influx of stock on the market due to job losses or financial distress. What Corelogic is predicting is that if a homeowner is in financial distress right now aren’t necessarily feeling a burden with holding a mortgage at the moment, however this could increase in September 2020 when the banks finalise the ‘mortgage holidays’ currently in place with homeowners due to COVID-19.

Brisbane Investment Properties and COVID-19

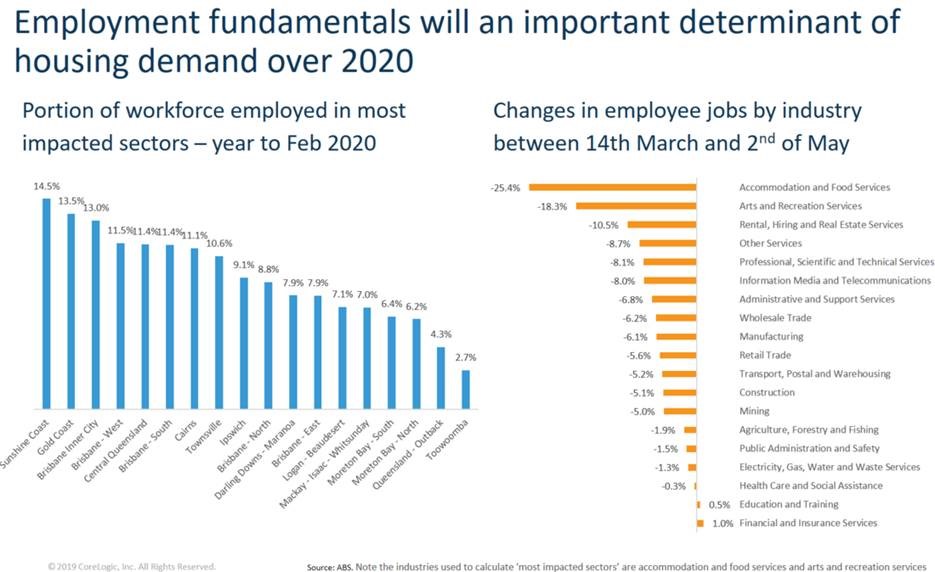

In regards to investment properties, the rental market is more likely to be impacted at the moment. There has been 7.3% decline in payroll (seen from single touch payroll) from mid March to start of May, this decline is mainly from hospitality and recreational services jobs that have caused this drop. Mostly Corelogic sees these sectors are mostly younger workers and mainly rentals, therefore seeing the rental market impacted more than property values. Calibre has seen tenants changing their housing situation due to loss of income, change of job and short term accommodation properties converting to long term rentals. It could be a reason in the significant uplift of the number of rental listings. Over April 2020, there was just under 1000 more listings on the rental market compared to April 2019, as a result, SQM Research reveals.