Renters insurance also referred to as “contents insurance”, renter’s insurance offers protection against all sorts of loss-incurring events. As a tenant, the best way to protect your belongings is to obtain renter’s insurance.

Despite how valuable this insurance is though, it’s still often overlooked.

Home contents in the average Australian’s home are said to be worth $69,400. But over less than half of Australian renters’ contents are protected.

This means that, on average, it would take you a whole year’s salary to replace your household belongings.

Sure, most of the events we’re talking about here are few and far between. But when they do occur, they can often leave uninsured renters financially devastated.

Before choosing a policy, you need to know how to go about choosing the best one for you. We’ve compiled a simple 4-step guide to help choose the best one for you.

1: Insuring Against Specific Events

There are a wide variety of events against which the home renter can insure future loss or damage. They include:

- Floods

- Fire & smoke damage

- Theft or burglary

- Storms

- Cyclones

- Vandalism

- Impact damage (such as falling trees)

- Lightning

- Accidental breakage of glass, ceramics, and so on

- Sudden escape of liquid (for example, burst pipes)

- Tsunamis

- Water leakages

- Earthquakes

Some companies allow policyholders such additional benefits as:

- Cash or Debit card theft

- Perishables — To protect foods and other organics in case of blackouts and power outages

- Injuries — To cover hospital and legal costs should anyone be injured while in your rented home

- Visitor’s contents — For when a guest sustains loss or injury while visiting your home

- Vet allowance — For when pets are injured by accident, or eat a whole bar of chocolate

- Temporary accommodation — In case of your home, contents, and therefore sleeping arrangements are destroyed.

Each company will offer different additional benefits at an extra cost.

2: Insurance Most Suitable for Your Belongings

There are a variety of factors that you should consider when choosing insurance.

These factors are not only within the belongings you want to protect — but they should also include the area in which you reside.

Specifically, the kinds of threats they pose to your property as a tenant.

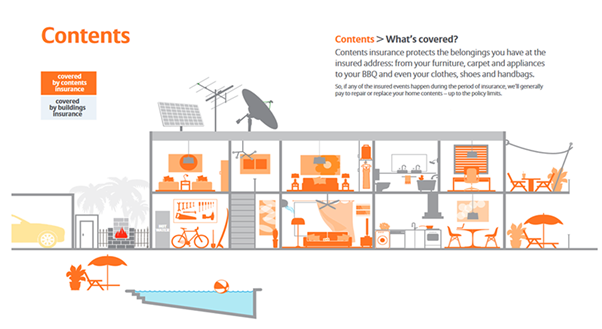

Now, an important question to answer at this point: What items can you cover using renters insurance?

The simple answer is practically anything that isn’t nailed to something.

We’re talking about:

- Curtains, blinds, and other furnishings

- Furniture

- Dog kennels

- Toys & Bicycles

- Sporting equipment

- Clothes

- Electronics — like PCs and TVs

- Garage Tools

- Cosmetics & Jewelry

Consider the kind of renters insurance policy that ought to be taken by a family living at a beach home in Townsville. Certainly, it’s different from one taken by an art collector living in Darwin, who happens to store some of her wares in her living room.

Of relevance here, of course, are geographical factors — like your locale’s climate and criminal index; that is the likelihood of you being burgled where you live.

Australian insurance companies offer an assortment of renters insurance packages. They include:

- Basic Renters Insurance — Your standard package that covers a range of events from floods to malicious vandalism

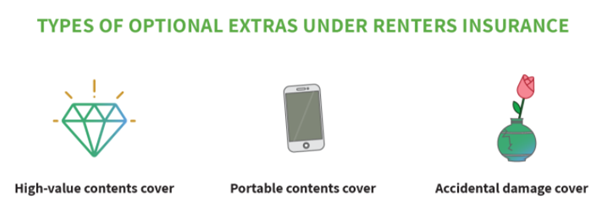

- High-value Renters Insurance — Which covers expensive items such as artwork, jewelry, and antique curios

- Portable Contents Insurance — Which covers items that you have to leave the house with. Cellphones, wristwatches, briefcases

- Accidental Damage Cover — Which covers such loss or damage as tripping and falling into your glass coffee table

- New for Old Contents Insurance — Which ensures that replaced items are brand new, regardless of their age at the time of theft or damage. This is often only an additional benefit.

3: What Can You Afford in Insurance Premiums

Here’s the good thing with contents insurance — its premiums are usually lesser than those of home insurance.

This is, of course, because replacing your home contents is way cheaper compared with the prospect of re-constructing a whole home.

Your contents insurance premiums will, among many other factors, be determined by:

- The geographical location of your home

- Your locale’s crime index — to indicate how likely you are to be burgled

- The total value of insured items

- The condition of your rented home — its age and rate of dilapidation

- Your locale’s climate risk index — to consider the likelihood of fires, floods etc.

- Purpose of home — whether it’s residential, commercial, or a storage premise

- Insurance tier — whether basic or comprehensive

4: Compare Insurance Providers Offering Contents Insurance

Once you have your insurance priorities straight, you can begin to check out the policies available in the market.

Australian insurance companies offer contents insurance policies at different rates with different provisions.

As you skim through what the insurance companies have to offer, here are the questions you ought to be thinking about:

- Does their coverage apply to your specific protection needs?

- How reputable are they with regards to claims handling?

- Are there any loopholes in their disclosure statement*?

- Do they offer discounts on their policies?

- Are they approachable and customer-centric?

- Are their costs reasonable?

*A disclosure statement elaborates on the contractual terms, conditions, rules, objectives, financial situation, or needs between the renter insurance policyholder and the company.

We Help Renters

At Calibre, we understand that finding the right quality house or apartment for rent can be a time-consuming and stressful process.

That’s why we have rentals properties on offer to suit every need and a team of committed realtors, on hand to help you secure your next home.

What’s more? You can book an inspection online at a time that suits you.

Give us a call on 07 3367 3411. Or, get social with us.